10 Tips for First-Time Home Buyers

The Exciting Journey of Becoming a Homeowner

Are you ready to take the leap into homeownership? Congratulations! Buying your first home is an exciting milestone that comes with a sense of accomplishment and the opportunity to establish roots in a community. However, the process of buying a home can feel overwhelming, especially for first-time buyers. With the competitive real estate market, it’s essential to be well-prepared before diving into the home-buying process.

To help you navigate this journey, we’ve compiled a comprehensive guide outlining the 10 essential steps to buying your first home. From saving for a down payment to selecting the right mortgage program, we’ll walk you through the entire process, ensuring that you feel confident and empowered every step of the way.

To help you navigate this journey, we’ve compiled a comprehensive guide outlining the 10 essential steps to buying your first home. From saving for a down payment to selecting the right mortgage program, we’ll walk you through the entire process, ensuring that you feel confident and empowered every step of the way.

1. Reach Out to your Victory Mortgage Solutions Loan Officer

He or she will help move you through the home-buying process efficiently. 😊

2. Start Saving Early

One of the first steps in buying a home is saving for a down payment. The amount you’ll need to save can vary, typically ranging from 3% to 20% of the home’s purchase price, depending on the loan type and lender requirements. Starting to save early is crucial to ensure you have enough funds when the time comes.

To kickstart your savings, take a close look at your budget and identify areas where you can cut back on expenses. Consider setting up a separate savings account specifically for your down payment funds to keep them separate from your regular spending. Additionally, explore loan options that offer small down payment requirements, such as FHA and VA loans. These programs can provide more flexibility for first-time buyers with limited funds.

10 essential tips for first-time Maryland home buyers. Contact us today for a free consultation on your eligibility. 301-682-2113 | info@victorymortgagesolutions.com | Contact Us

3. Assess Your Credit Score

Your credit score plays a vital role in determining your eligibility for a mortgage loan and the interest rate you’ll receive. Take the time to review your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Look for any errors or discrepancies and take steps to rectify them.

If your credit score needs improvement, focus on paying off outstanding debts and reducing your credit card balances. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management. Building a strong credit history takes time, so it’s essential to start working on improving your score as early as possible.

Navigating the real estate market can be complex, especially for first-time buyers. To simplify the process and ensure you make informed decisions, it’s crucial to work with a reliable and experienced real estate agent.

4. Determine Your Budget And Affordability

Before you start house hunting, it’s crucial to determine how much you can afford. Use an online mortgage calculator to estimate your monthly payments based on different loan amounts, interest rates, and down payment percentages. This will give you a rough idea of what you can comfortably afford within your budget.

However, keep in mind that there are other costs associated with homeownership beyond your mortgage payment. Consider expenses such as property taxes, homeowners insurance, utilities, and maintenance when calculating your overall budget. It’s essential to have a clear understanding of your financial capabilities to avoid stretching yourself too thin.

5. Explore Mortgage Programs

Many states offer several mortgage programs specifically designed to assist first-time homebuyers. These programs provide various benefits, including competitive interest rates, down payment assistance, and grants. Familiarize yourself with the different options available to determine which program best suits your needs.

Two loan programs most states offer is 1st Time Advantage loan and the Flex loan. The 1st Time Advantage loan is tailored for first-time homebuyers and offers competitive interest rates. It also provides options for down payment assistance, such as the 1st Time Advantage 5000 and 1st Time Advantage 5% Loan.

On the other hand, the Flex loan is open to both first-time and repeat buyers. It offers competitive 30-year fixed rates and includes down payment assistance in the form of a no-interest loan or grant. These programs aim to make homeownership more accessible and affordable for residents.

6. Research Down Payment Assistance Programs

In addition to the Mortgage Program, there are various down payment assistance programs available to help homebuyers. These programs offer financial support to cover a portion of your down payment or closing costs, reducing the upfront financial burden.

For example, the 1st Time Advantage 5000 and Flex 5000 programs provide a zero-interest second mortgage of $5,000 to use towards your down payment and closing costs. Additionally, some programs offer “partner matches” that can match funds or grants provided by employers, community organizations, or local governments.

It’s worth exploring these options to maximize your savings and potentially reduce the amount you need to contribute out of pocket. Research local and national down payment assistance programs to find additional resources that can support your homeownership journey.

7. Find A Reliable Real Estate Agent

Navigating the real estate market can be complex, especially for first-time buyers. To simplify the process and ensure you make informed decisions, it’s crucial to work with a reliable and experienced real estate agent.

Ask for recommendations from friends, family, and colleagues who have recently purchased homes. Look for agents who have a good understanding of the local market and can guide you through each step of the homebuying process. A knowledgeable agent will help you find properties that align with your needs and negotiate favorable terms on your behalf.

8. Get Pre-Approved For A Mortgage

Before you start touring homes, it’s highly recommended to get pre-approved for a mortgage. This involves submitting a loan application and providing necessary documentation to a lender who will assess your financial situation and determine the loan amount you qualify for.

Getting pre-approved offers several advantages. It demonstrates to sellers that you’re a serious buyer and increases your chances of having your offer accepted. Additionally, pre-approval gives you a clear understanding of your budget and allows you to shop for homes within your price range confidently.

9. Start House Hunting

Now comes the fun part – house hunting! Armed with your budget, pre-approval, and a trusted real estate agent, you can begin exploring properties in your desired area. Make a list of your needs and wants, considering factors such as the number of bedrooms, bathrooms, garage space, and location.

Visit potential homes and take notes or pictures to help you remember each property. Consider factors beyond the house itself, such as the neighborhood, nearby amenities, and commute times. It’s also a good idea to visit homes at different times of the day to get a comprehensive understanding of the area.

Maintain open communication with your real estate agent, providing feedback on each property you visit. This will help them refine their search and find properties that best align with your preferences and budget.

10. Complete The Closing Process

Once you’ve found your dream home and had your offer accepted, it’s time to navigate the closing process. This involves several essential steps, including getting a home inspection, home appraisal, and finalizing your loan.

A home inspection is crucial to identify any potential issues or repairs needed before finalizing the purchase. An appraiser will assess the value of the property to ensure it aligns with the agreed-upon price. Finally, your lender will review all necessary documentation and complete the final loan approval process.

On the day of closing, you’ll sign various legal documents and pay the remaining closing costs. This is an exciting moment as you officially become a homeowner. Don’t forget to celebrate and start planning your move into your new home!

Conclusion

Buying your first home is an exciting and rewarding journey. By following these 10 tips, you’ll be well-prepared to navigate the home-buying process with confidence. Remember to save early, assess your credit score, determine your budget, explore mortgage programs, and research down payment assistance options. Collaborate with a reliable real estate agent, get pre-approved for a mortgage, and start house hunting. Finally, complete the closing process and get ready to enjoy the pride and joy of homeownership.

Throughout the process, always seek guidance from professionals, and don’t hesitate to ask questions. Victory Mortgage Solutions are here to support you every step of the way. Happy house hunting!

2024 Housing Market Recap: Looking Ahead to 2025 Opportunities in the D.C. Metro Area

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

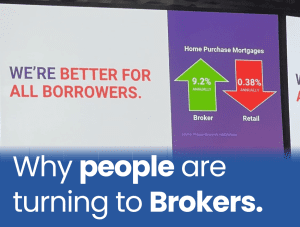

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

Home Buying Resources