Introduction

In the labyrinth of mortgage financing, the distinction between mortgage brokers and mortgage bankers/retailers often remains veiled, leaving many homebuyers unaware of the significant benefits of choosing a mortgage broker over a mortgage banker/retailer. Understanding this contrast is pivotal for anyone navigating the path to homeownership.

Explore the invaluable role of mortgage brokers in your home buying journey. Contact us today for a free consultation on your eligibility. 301-682-2113 | info@victorymortgagesolutions.com | Contact Us

While both play critical roles in securing home loans, mortgage brokers and bankers operate on fundamentally distinct principles, offering varied levels of service and expertise. As a homebuyer, discerning between the two can profoundly impact your journey towards obtaining the ideal mortgage terms. In this article, we unravel the intricacies of this disparity, shedding light on why choosing a mortgage broker can be the key to unlocking a seamless and tailored home buying experience. From personalized guidance and access to multiple lenders to transparent communication and advocacy for your best interests, discover how mortgage brokers stand as unwavering allies in your quest for homeownership success.

Personalized Service And Expertise

Mortgage brokers offer personalized service tailored to your specific financial situation and needs. With access to a wide range of lenders, they can provide expert advice and help you navigate the complex mortgage process. Unlike bankers who may have less stringent training standards, brokers undergo rigorous certification processes to ensure they are equipped to find the best mortgage terms for you.

Access To Multiple Lenders And Loan Options

Brokers work with multiple lenders, allowing them to offer a wide variety of loan options. This gives you the flexibility to choose the best terms and rates that suit your needs. In contrast, bankers/retailers are limited to the loan products offered by their employer, restricting your options for finding the most competitive rates and terms.

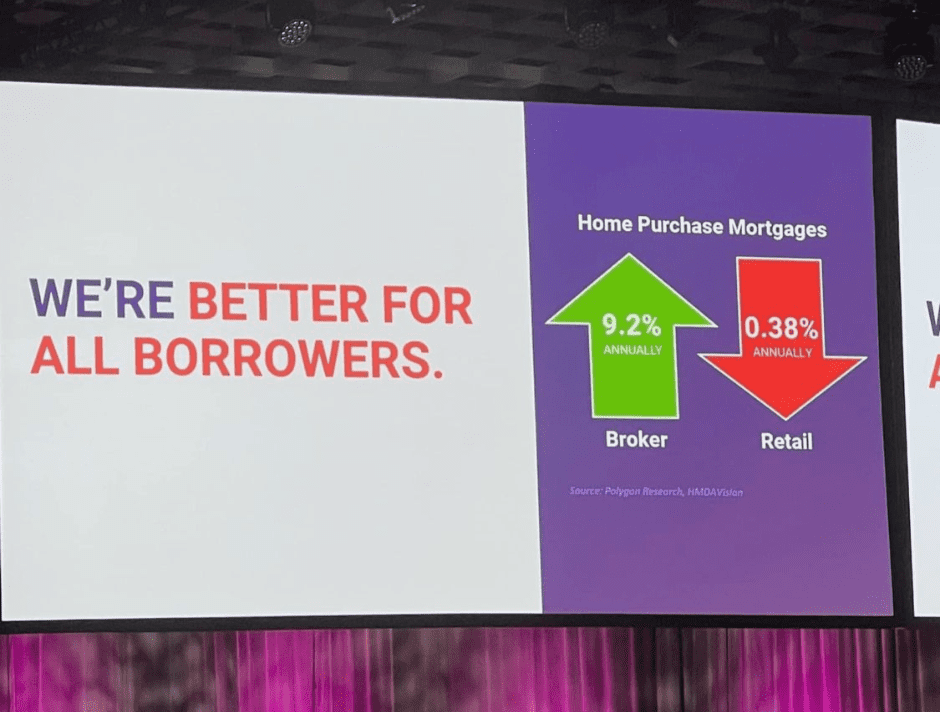

Competitive Rates And Lower Fees

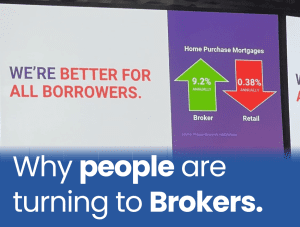

Mortgage brokers can often secure competitive rates and lower fees compared to retail lenders. They negotiate on your behalf with lenders, helping you save money on closing costs and other fees associated with your loan. This negotiation power stems from their relationships with lenders and their ability to shop around for the best deals.

Advocacy For The Borrower

Mortgage brokers work exclusively for you, the borrower, advocating for your best interests throughout the loan process. They are committed to finding you the most competitive rates and terms, unlike bankers who may prioritize the interests of the bank. This dedication to client satisfaction is reflected in their accessibility and personalized service.

Flexibility In Loan Approval

Brokers have the flexibility to find lenders who are willing to work with borrowers facing challenges, such as lower credit scores or unique financial circumstances. They can source loans from lenders with less stringent requirements, expanding your options for loan approval. In contrast, bankers may be limited to their own product guidelines, potentially excluding borrowers who could qualify through alternative lenders.

Transparency And Clear Communication

Mortgage brokers provide clear communication throughout the mortgage process, helping you understand the complexities involved. They explain the terms and conditions of different loan options, ensuring you make informed decisions. This transparency builds trust and confidence in the broker-client relationship, fostering a smoother experience compared to the potential confusion with bankers who may operate under less transparent practices.

Time And Effort Savings

Working with a mortgage broker saves you time and effort by streamlining the loan application process. Brokers handle the paperwork, communication with lenders, and other administrative tasks, freeing you from the hassle of managing multiple loan applications on your own. This efficiency allows you to focus on other aspects of your home buying journey.

Availability And Accessibility

Mortgage brokers are accessible to their clients 24/7, providing prompt responses to questions and concerns. Their commitment to client satisfaction means they prioritize your needs and ensure you receive timely assistance throughout the loan process. In contrast, bankers may have limited availability for appointments and may not be as responsive to inquiries outside of scheduled meetings.

Client-Centric Approach

Brokers prioritize client satisfaction and strive to deliver exceptional service throughout the mortgage process. Their personalized approach, attention to detail, and dedication to finding the best mortgage terms for you result in a more positive and satisfying experience overall. This client-centric focus sets brokers apart from bankers and ensures you receive the support and guidance you need to achieve your homeownership goals.

Conclusion

In the realm of securing a mortgage, the choice between a broker and a retailer/banker isn’t merely about preference—it’s about securing the best possible outcome for your homeownership journey. As we’ve explored the myriad advantages of working with a mortgage broker, it’s abundantly clear that this partnership transcends mere transactional convenience; it’s a gateway to personalized service, expert guidance, and unwavering advocacy.

By opting for a mortgage broker, you’re not just selecting a facilitator of loans; you’re enlisting a dedicated ally committed to your financial well-being and homeownership aspirations. From accessing a diverse array of lenders to navigating complex negotiations, mortgage brokers stand as stalwart guardians of your interests, ensuring that every step of the process is tailored to your unique needs and circumstances.

In essence, choosing a broker over a retailer or banker is more than a practical decision—it’s a strategic investment in your future. With their client-centric approach, transparent communication, and tireless advocacy, mortgage brokers empower you to embark on your homeownership journey with confidence, clarity, and peace of mind.

So, as you embark on this pivotal chapter of your life, remember: the path to homeownership is illuminated not by the convenience of options, but by the wisdom of informed choices. And in choosing a mortgage broker, you’re not just choosing a lender—you’re choosing a trusted partner dedicated to helping you achieve your dreams of homeownership.

Home Buying Resources

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

How First-Time Homebuyers Dominate Delaware: Quick Tips On Mortgage Options, Rates, Credit Score, And More!

“Benefits of Using a Mortgage Broker.” Brokers Are Better, brokersarebetter.com/why-brokers-are-better/#:~:text=Brokers%20work%20for%20the%20borrower,you%20are%20a%20repeat%20customer.

“Why Choosing a Mortgage Broker is Better than a Retail Lender.” Lending Maven, lendingmaven.com/mortgage-rates-denver-colorado/why-choosing-a-mortgage-broker-is-better-than-a-retail-lender/.

“Mortgage Banker Vs. Mortgage Broker: Why Independence Is Better.” AIME Group, aimegroup.com/mortgage-banker-vs-mortgage-broker-why-independence-is-better/.

“Mortgage Brokers: Advantages and Disadvantages.” Investopedia, www.investopedia.com/financial-edge/1112/advantages-and-disadvantages-of-using-a-mortgage-broker.aspx.

“10 Proven Reasons Why Brokers are Better.” Future Home Loans, future.loans/reasons-why-brokers-are-better/.