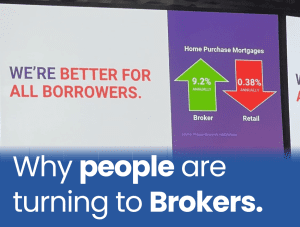

Navigating the path to homeownership can be challenging for first-time buyers, but Delaware stands out as a state that actively supports and encourages this endeavor. With an array of programs designed to address financial constraints and provide educational resources, Delaware creates a conducive environment for individuals taking their initial steps into property ownership. Discover how Delaware’s mortgage options, competitive rates, and credit score considerations contribute to a smoother home buying journey.

You do not need to be a first-time homebuyer to qualify for all of these options. Contact us today for a free consultation on your eligibility. 301-682-2113 or info@victorymortgagesolutions.com | Contact Us

Down Payment Assistance Programs in Delaware

Delaware’s commitment to helping first-time homebuyers is evident in various down payment assistance programs. Initiatives like the DSHA Preferred Plus, DSHA Homeownership Loan, and Neighborhood Stabilization Program play a pivotal role in assisting buyers in overcoming financial hurdles, ensuring that mortgage rates and credit score are not barriers to homeownership.

Interest-Free Loans for First-Time Homebuyers

Programs like DSHA Preferred Plus go beyond traditional assistance by offering interest-free loans of up to 5% of the mortgage amount, providing financial flexibility without incurring additional interest costs. Explore how these loans cater to buyers with varying credit scores and contribute to a more accessible mortgage process.Interest Rates for Delaware First-Time Homebuyers

The DSHA Homeownership Loan Program offers 30-year fixed-rate mortgages with competitive interest rates, empowering buyers with lower monthly payments or the ability to consider more expensive homes. Learn how favorable mortgage rates in Delaware benefit first-time buyers, regardless of their credit score.Tax Credits for First-Time Homebuyers in Delaware

Delaware’s First-Time Home Buyer Tax Credit offers an annual federal tax reduction equivalent to 35% of mortgage interest paid, lasting the entire lifetime of the loan. This incentive, combined with favorable mortgage rates, helps buyers with varying credit scores save on homeownership costs.

Federal Programs Supporting Delaware Homebuyers

First-time buyers in Delaware benefit from access to national programs such as FHA, VA, USDA, Good Neighbor Next Door, and Fannie Mae/Freddie Mac. This diversity ensures options for buyers with different credit scores and income levels, promoting inclusive homeownership opportunities.

Historically Attractive Median Home Prices in Delaware

Delaware boasts median home prices slightly below the national median, enhancing accessibility for first-time homebuyers. Explore how favorable median prices, combined with competitive mortgage rates, create a favorable landscape for prospective homeowners, regardless of their credit score.

Variety of Loan Options

Delaware provides a spectrum of loan options, ranging from conventional loans to low-down-payment programs like Conventional 97, FHA loans, VA loans, and USDA loans. This flexibility accommodates buyers with varying credit scores and financial situations, ensuring that mortgage options are tailored to individual needs.

Supportive City Programs Enhancing Homebuying Options

Delaware’s major cities offer down payment assistance programs that complement state-level initiatives, expanding choices for first-time homebuyers. Explore city-specific programs and understand how they cater to buyers with different credit scores, providing additional support in navigating the mortgage process.

Educational Resources for Informed Decision-Making

Programs like the DSHA Homeownership Loan prioritize housing counseling, empowering buyers with valuable education on homeownership risks, responsibilities, and rewards. Discover how these resources support informed decision-making, regardless of credit score, ensuring a smooth transition into homeownership.

No PMI Requirement in Certain Loan Programs

Certain loan programs, such as VA and NADL, eliminate the need for private mortgage insurance (PMI), reducing homeownership costs for eligible borrowers. Understand the criteria for PMI exemption and how it benefits buyers with varying credit scores, making homeownership more affordable in Delaware.

Conclusion

Delaware’s combination of state-specific programs and access to federal initiatives creates a favorable environment for first-time homebuyers. Whether through financial support, educational resources, or diverse mortgage options, Delaware positions itself as a welcoming state for those embarking on the exciting journey of owning their first home. For a seamless and informed homebuying experience, leverage the unique advantages Delaware offers to make your dream of homeownership a reality.

Home Buying Resources

References

Warden, Peter, and Ryan Tronier. “Delaware First-Time Home Buyer: 2024 Programs and Grants.” Kiss Your Landlord Goodbye, 9 Oct. 2023, https://kissyourlandlordgoodbye.com/help-for-homebuyers/#:~:text=For%20First%2DTime%20Homebuyers,up%20to%20%242%2C000%20a%20year.

Smith, Liz. “First-Time Home Buyer Programs in Delaware.” SmartAsset, 6 Sept. 2023, https://smartasset.com/mortgage/first-time-home-buyer-programs-delaware.

“Delaware State Housing Authority Launches Four New Homeownership Programs for First-Time and Repeat Homebuyers.” Delaware.gov, 20 June 2023, https://news.delaware.gov/2023/06/20/delaware-state-housing-authority-launches-four-new-homeownership-programs-for-first-time-and-repeat-homebuyers/.

“Delaware First-Time Home Buyers.” Delaware Mortgage Loans, https://delawaremortgageloans.net/delaware-first-time-home-buyers/.

“First-Time Home Buyer Programs in Delaware.” The Mortgage Reports, https://themortgagereports.com/88537/delaware-first-time-home-buyer-programs-grants.