Navigating the housing market is especially daunting as a first-time homebuyer, but it can lend a key advantage over the homebuyers; that is access to State Mortgage Programs. These programs are designed to help make buying a house easier and more affordable for first time home buyers by providing low down payments, closing assistance, grants, and competitive or flexible mortgage rates. Many states even offer additional perks for Military, Veterans, specific types of housing, and support needs. In addition to being a first-time home buyer, there there is usually criteria that varies between states. Below is a list of the criteria we’ve typically observed between states.

- Purchasing a primary residence and not owning any other properties.

- Meeting the income limits set by the program.

- Completing homebuyer education or counseling.

- Having a minimum credit score, which varies depending on the loan type (e.g., 640-680 for conventional loans).

- Being a first-time homebuyer or meeting specific exemptions.

Still confused? Call a professional today! 301-682-2113 | info@victorymortgagesolutions.com | Contact Us

If you are a house hunting in the states of Maryland, Virginia, West Virginia, Pennsylvania, Florida, or South Carolina call us or click here to fill out a loan application for a free preliminary evaluation of your eligibility for these programs by a professional loan officer. It’s important to carefully review the eligibility requirements for the program you’re interested in using to ensure you meet all the necessary criteria. If you have any questions or need assistance, don’t hesitate to reach out today.

2024 Housing Market Recap: Looking Ahead to 2025 Opportunities in the D.C. Metro Area

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

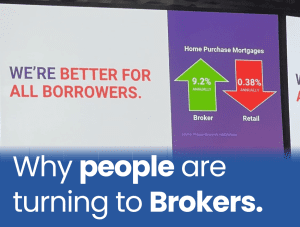

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

Home Buying Resources