Congratulations on embarking on the exciting journey of homeownership! As a trusted mortgage broker, we understand that the mortgage process can seem overwhelming, especially for first-time homebuyers. In this blog post, we will provide you with valuable tips and insights to help navigate the mortgage process with ease. From understanding your financial readiness to securing the right loan, we’ll guide you every step of the way.

First-time homebuyer? Navigate the mortgage process with ease using our expert tips and insights! Contact us today for a free consultation on your eligibility. 301-682-2113 | info@victorymortgagesolutions.com | Contact Us

Assessing Your Financial Readiness: Before diving into the homebuying process, it’s essential to assess your financial readiness. We’ll discuss key factors to consider, such as determining a comfortable budget, saving for a down payment, and reviewing your credit score. We’ll provide practical tips for improving your financial standing, including paying off debts, establishing a savings plan, and maintaining a good credit history.

Pre-Approval Process: Getting pre-approved for a mortgage is an invaluable step that provides you with a clear picture of your borrowing capacity. We’ll walk you through the pre-approval process, explaining the documentation required and the factors lenders consider when assessing your application. We’ll highlight the benefits of pre-approval, such as strengthening your negotiating power with sellers and streamlining the homebuying process.

Choosing the Right Mortgage: Selecting the right mortgage is crucial to ensure it aligns with your financial goals and long-term plans. We’ll discuss different mortgage types we covered in the previous blog post, such as fixed-rate mortgages, ARMs, and government-backed loans. We’ll provide guidance on evaluating your needs, considering factors like loan term, interest rate, and monthly payment affordability. We’ll also shed light on the importance of comparing loan offers from multiple lenders to secure the best terms.

The Role of Down Payments: Understanding the significance of down payments is essential for first-time homebuyers. We’ll explain how down payments impact your loan options, including factors such as loan-to-value ratio and private mortgage insurance (PMI). We’ll provide strategies for saving for a down payment and discuss alternative options, such as down payment assistance programs or gifts from family members.

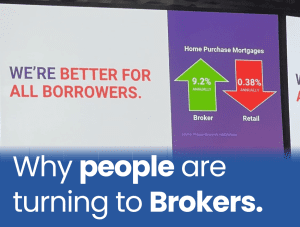

Working with Professionals: Navigating the mortgage process can be smoother with the assistance of professionals. We’ll discuss the roles of real estate agents, mortgage brokers, and loan officers, explaining how they can help simplify the process and provide valuable guidance. We’ll provide tips for selecting reliable professionals and fostering effective communication throughout the homebuying journey.

The mortgage process may seem daunting, especially for first-time homebuyers, but with the right knowledge and guidance, it can be a rewarding and successful experience. By assessing your financial readiness, getting pre-approved, choosing the right mortgage, understanding down payments, and working with professionals, you’ll be well-equipped to navigate the process with ease. As your trusted mortgage broker, we are here to support you, answer your questions, and ensure a smooth journey towards homeownership. Remember, being prepared and informed is the key to a successful homebuying experience.

2024 Housing Market Recap: Looking Ahead to 2025 Opportunities in the D.C. Metro Area

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

Home Buying Resources