Back in January, we shared with you predictions for 2024 rates and the housing market according to some of the industry’s leading experts. Now, in hindsight of the second Fed meeting of the year we’re circling back to some of these experts as well as some new ones, to see if their predictions have shifted.

Discover how Fed decisions could impact housing rates and prices. Contact us today for a free consultation on your eligibility. 301-682-2113 | info@victorymortgagesolutions.com | Contact Us

Last time we checked, experts suggested anywhere from a slight increase to a flat or slight decrease in national home prices, with sustained improvements in inflation driving rates lower. Most of our sources collectively predicted a gradual decline in mortgage rates throughout 2024. With year-end projections for 30-year fixed-rate mortgages varying, ranging from 5.75% to 6.6%, and home values increasing by 5.5%, driven by rising demand, limited supply, and government policy impacts.

Now, following the highly anticipated March 2024 Federal Reserve meeting, here is what economists and analysts are reporting after closely examining the implications of home prices, mortgage rates, and changes in home values.

Home Prices

The outcome of the March 2024 Fed meeting has prompted speculation about the trajectory of home prices in the near future. According to CNN, there is anticipation for the Federal Reserve to announce a series of interest rate hikes. This could potentially impact home prices, as higher interest rates often lead to decreased affordability, thereby putting downward pressure on housing demand and prices.

Mortgage Rates

One of the most immediate impacts of the March 2024 Fed meeting is expected to be on mortgage rates. CNBC suggests that a more hawkish stance by the Federal Reserve could lead to an increase in mortgage rates, as the central bank aims to control inflation by tightening monetary policy. This could translate to higher borrowing costs for homebuyers. According to The New York Times, rising inflation rates have intensified pressure on the Fed to act decisively, potentially leading to more aggressive policy measures. As a result, homebuyers may need to act quickly to secure mortgages at current rates before potential rate hikes take effect.

However, CNBC reports that while interest rate hikes may initially exert downward pressure on home prices, the overall impact could be moderated by other factors such as strong demand and limited housing supply. Additionally, Barron’s notes that market volatility resulting from the Fed’s decisions could introduce uncertainty into the housing market, potentially impacting buyer behavior and influencing price trends.

Changes in Home Values

The changes in mortgage rates and overall economic conditions following the March 2024 Fed meeting are likely to influence the trajectory of home values. Barron’s highlights that market volatility stemming from the Fed’s decisions could impact home values, as buyers and sellers navigate uncertain conditions.

However, despite potential short-term fluctuations, The New York Times suggests that the Fed’s focus on addressing inflation concerns could contribute to a more stable and sustainable housing market in the long term. By proactively managing inflation, the Federal Reserve aims to prevent excessive price increases that could erode the purchasing power of homebuyers over time, ultimately supporting the value of real estate assets.

What this could mean for homebuyers

In hindsight of the second Fed meeting of the year, it’s evident that the housing market landscape is evolving, with great potential implications for homebuyers. While there may be speculation about the trajectory of home prices and mortgage rates following the March Fed meeting, prospective buyers need to consider the broader context. Back in January, industry experts predicted varying scenarios for rates and home prices throughout 2024, highlighting factors such as inflation, demand-supply dynamics, and government policies. Now, with the Fed’s focus on addressing inflation concerns, despite potential short-term fluctuations in prices and mortgage rates, the Fed’s proactive measures to manage inflation aim to foster a more stable and sustainable housing market over the long term.

This suggests that taking advantage of current market conditions, before potential rate hikes take effect, could offer homebuyers an opportunity to secure mortgages at relatively favorable rates and position themselves for long-term financial stability and asset appreciation. Therefore, for those considering entering the housing market, now might be an opportune time to make a move and capitalize on the potential benefits of the current economic landscape.

Home Buying Resources

2024 Housing Market Recap: Looking Ahead to 2025 Opportunities in the D.C. Metro Area

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

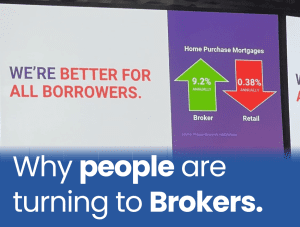

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

References

What to Expect from the Fed Meeting.” CNN, 20 Mar. 2024, www.cnn.com/2024/03/20/economy/what-to-expect-from-the-fed-meeting/index.html.

“Fed Meeting Today: Live Updates on March Fed Rate Decision.” CNBC, 20 Mar. 2024, www.cnbc.com/2024/03/20/fed-meeting-today-live-updates-on-march-fed-rate-decision.html.

“Fed FOMC Meeting: Rate Decision, Powell Speech Today.” Barron’s, 20 Mar. 2024, www.barrons.com/livecoverage/fed-fomc-meeting-rate-decision-powell-speech-today.

“Fed Meeting to Weigh the Threat of Inflation Against the Risk of a Slowdown.” The New York Times, 20 Mar. 2024, www.nytimes.com/2024/03/20/business/fed-meeting-interest-rates.html.

“Mortgage Rates and Housing in 2024: According to Experts, Insights, and Forecasts Compared.” Victory Mortgage Solutions, Date Published (if available), www.victorymortgagesolutions.com/mortgage-rates-and-housing-in-2024-according-to-experts-insights-and-forecasts-compared/.