Embarking on your journey of homeownership in Pennsylvania? This comprehensive guide is your key to understanding the advantages you have as a first-time homebuyer. From financial aid programs to city-specific grants, discover the opportunities that make Pennsylvania an ideal state for aspiring homeowners. Explore the diverse support offered by statewide and local organizations in Pennsylvania. Gain insights into educational courses, counseling services, and potential cash assistance, creating a robust foundation for your home buying journey.

You do not need to be a first-time homebuyer to qualify for all of these options. Contact us today for a free consultation on your eligibility. 301-682-2113 or info@victorymortgagesolutions.com | Contact Us

Financial Aid Programs for Homebuyers

Dive into the financial aid landscape designed for First-Time Homebuyer Pennsylvania. Discover lucrative loan and grant options that provide substantial assistance, specifically targeting down payments and closing costs, ensuring a smoother financial transition into homeownership. Some of these programs include Pennsylvania Housing Finance Agency (PHFA), HOMEstead Downpayment and Closing Cost Assistance, Keystone Advantage Assistance Loan Program, First Front Door (FFD) Program, Pennsylvania County-Specific Programs. More on these programs to follow.

Pennsylvania’s Real Estate Landscape

Navigate through the dynamics of Real Estate Market Pennsylvania. Despite challenges such as limited inventory and rising prices, gain confidence from the median sales price of $210,132 in October 2022, reflecting a resilient market with a 9.5% year-over-year increase.

Affordable Loan Options In Pennsylvania

Uncover a range of loan options catering to first-time homebuyers. From competitive conventional loans to low-down-payment choices like Conventional 97, FHA, VA, and USDA loans, Pennsylvania provides a spectrum of financial solutions tailored to diverse homebuying needs.

PHFA’s Role In Empowering First-Time Homebuyers

Delve into the pivotal role played by the Pennsylvania Housing Finance Agency (PHFA). Explore loan programs, including HFA Preferred (Lo MI) and Keystone Forgivable in Ten Years Loan (K-FIT), strategically designed to promote affordable housing and streamline the home financing process. More on these programs to follow.

Mortgage Credit Certificate (MCC) Advantage

Learn about the Mortgage Credit Certificate (MCC) and its role in reducing federal income tax obligations for eligible first-time buyers. Uncover the financial benefits that enhance the overall affordability of homeownership.

Free Homebuyer Education With PHFA

Understand the importance of free homebuyer education and counseling services offered by PHFA. Discover how these resources empower buyers, with a special focus on in-person courses for those with credit scores below 680.

HFA Preferred (Lo MI) Program Insights

Explore the distinctive features of the HFA Preferred (Lo MI) program, a 30-year fixed-rate mortgage with flexible underwriting requirements. Learn about the 3% minimum down payment and the unique payment structure directing mortgage payments to PHFA.

Keystone Forgivable In Ten Years Loan (K-FIT) Program Details

Gain insights into the innovative K-FIT program, allowing borrowers to borrow up to 5% of the home’s value with annual loan forgiveness of 10%. Navigate through eligibility criteria, including credit score requirements and asset thresholds.

Localized Grants In Pennsylvania Cities

Uncover city-specific grant programs in Pennsylvania, such as the Philly First Home program and the Down Payment/Closing Cost Assistance Grant in Pittsburgh. Explore how these initiatives address regional challenges, providing targeted support based on income and local market dynamics.

Conclusion

As you embark on your first-time homebuying adventure in Pennsylvania, remember that the Keystone State is more than a destination—it’s a partner in your homeownership journey. From statewide assistance programs to localized grants, Pennsylvania’s commitment to affordability and accessibility sets the stage for your success. Consider this a checklist of opportunities you should consider taking advantage of as a First-Time Homebuyer Pennsylvania, and step confidently into the world of homeownership. The keys to your dream home await in the heart of Pennsylvania.

2024 Housing Market Recap: Looking Ahead to 2025 Opportunities in the D.C. Metro Area

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

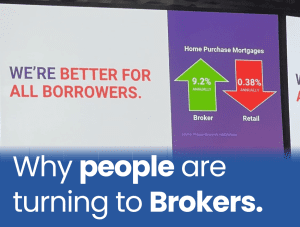

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

Home Buying Resources

References

New American Funding. “Pennsylvania First-Time Homebuyer Guide.” New American Funding,newamericanfunding.com/blog/pennsylvania-first-time-homebuyer-guide/.

The Mortgage Reports. “PA First-Time Home Buyer Programs & Grants.” The Mortgage Reports,themortgagereports.com/78608/pa-first-time-home-buyer-programs-grants.

“Pennsylvania First-Time Homebuyer Assistance Programs.” Bankrate,www.bankrate.com/mortgages/pennsylvania-first-time-homebuyer-assistance-programs/.

Philly REO. “Pennsylvania First-Time Home Buyer: 2023 Programs and Grants.” Philly REO, com/pennsylvania-first-time-home-buyer-2023-programs-and-grants/.

New American Funding. “Pennsylvania First-Time Homebuyer Guide.” New American Funding,newamericanfunding.com/blog/pennsylvania-first-time-homebuyer-guide/.

The Mortgage Reports. “PA First-Time Home Buyer Programs & Grants.” The Mortgage Reports,themortgagereports.com/78608/pa-first-time-home-buyer-programs-grants.

“Pennsylvania First-Time Homebuyer Assistance Programs.” Bankrate,www.bankrate.com/mortgages/pennsylvania-first-time-homebuyer-assistance-programs/.