As a trusted mortgage broker, our goal is to empower homebuyers with the knowledge they need to make informed decisions about their mortgage options. In this comprehensive guide, we will delve into the various mortgage options available, providing insights and tips that will help you navigate the complex world of home financing. Whether you’re a first-time homebuyer or looking to refinance, understanding these mortgage options is crucial to finding the right fit for your unique needs.

Ready to buy a home? Discover your best mortgage options now! Contact us today for a free consultation on your eligibility. 301-682-2113 | info@victorymortgagesolutions.com | Contact Us

Fixed-Rate Mortgages: One of the most popular mortgage options is a fixed-rate mortgage. With this type of loan, the interest rate remains constant throughout the entire term, providing stability and predictability. We’ll explain the benefits of fixed-rate mortgages, including budgeting advantages and long-term cost savings. We’ll also address factors to consider, such as the term length and the impact of inflation on fixed-rate mortgages.

Adjustable-Rate Mortgages (ARMs): For those seeking flexibility in their mortgage, adjustable-rate mortgages (ARMs) can be an attractive option. In this section, we’ll discuss how ARMs work, including introductory fixed-rate periods and subsequent rate adjustments. We’ll cover the pros and cons of ARMs, including the potential for lower initial rates and the importance of understanding rate adjustment caps and indexes. We’ll provide guidance on evaluating your risk tolerance and financial goals when considering an ARM.

Government-Backed Mortgages: Government-backed mortgages, such as those insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA), offer distinct advantages for certain borrowers. We’ll explain the eligibility requirements and benefits of these programs, such as lower down payment options and relaxed credit score requirements. We’ll also discuss considerations like mortgage insurance premiums and VA loan funding fees to help you determine if these programs align with your needs.

Jumbo Loans: When purchasing a high-value property, you may require a jumbo loan that exceeds the conventional loan limits. We’ll explore the unique features of jumbo loans, including higher loan amounts, stricter qualification criteria, and potential interest rate variations. We’ll guide you through the application process and provide tips on improving your chances of securing a jumbo loan.

Specialty Mortgage Programs: There are specialized mortgage programs designed to cater to specific circumstances. We’ll cover programs such as first-time homebuyer assistance, renovation loans, and physician loans, highlighting the benefits and requirements of each. We’ll provide examples of how these programs can benefit borrowers in different scenarios and how to determine if you qualify.

Call us today to discuss these mortgage options in detail! Understanding the range of mortgage options available to you is a crucial step in the homebuying process. By exploring the features, benefits, and considerations of different mortgage types, you can make an informed decision that aligns with your financial goals. As your trusted mortgage broker, we are here to guide you through this journey, answering your questions and providing personalized assistance to ensure you find the perfect mortgage option for your dream home. Remember, knowledge is power when it comes to navigating the mortgage landscape.

2024 Housing Market Recap: Looking Ahead to 2025 Opportunities in the D.C. Metro Area

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

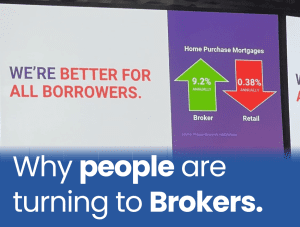

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

Home Buying Resources