2024 Housing Market Recap: Looking Ahead to 2025 Opportunities in the D.C. Metro Area

As 2024 comes to a close, the real estate markets across Washington D.C., Maryland, Virginia, and West Virginia have shown impressive growth. In this end-of-year recap, we examine the key trends that defined the housing market in 2024 and consider how these areas are positioned for continued success in 2025. From urban hubs like Washington, […]

Optimistic Mortgage Rate Projections For 2024: A Story From Every Major Source

As 2024 progresses, the outlook on mortgage rates remains varied, with different financial news outlets offering their perspectives on potential changes. This article summarizes the optimistic viewpoints from Forbes, Bloomberg, and Business Insider, and several other sources, providing a comprehensive understanding of the potential for lower mortgage rates. NerdWallet: Gradual Decline Expected NerdWallet anticipates a […]

Mixed Outlooks on Mortgage Rates for 2024: Analyzing Major Financial News Sources

Here’s where we are… As 2024 progresses, mortgage rates remain a hot topic, with different financial news outlets providing varied perspectives on their trajectory. Here’s a comprehensive look at what Bloomberg, Forbes, The Economist, and The Wall Street Journal predict for the rest of the year, alongside insights from NerdWallet, The Week, Business Insider, and […]

Housing Market Predictions Revisited: Insights Post-Fed Meeting! If and how rates and home prices may shift after the latest Fed decisions.

Back in January, we shared with you predictions for 2024 rates and the housing market according to some of the industry’s leading experts. Now, in hindsight of the second Fed meeting of the year we’re circling back to some of these experts as well as some new ones, to see if their predictions have shifted. […]

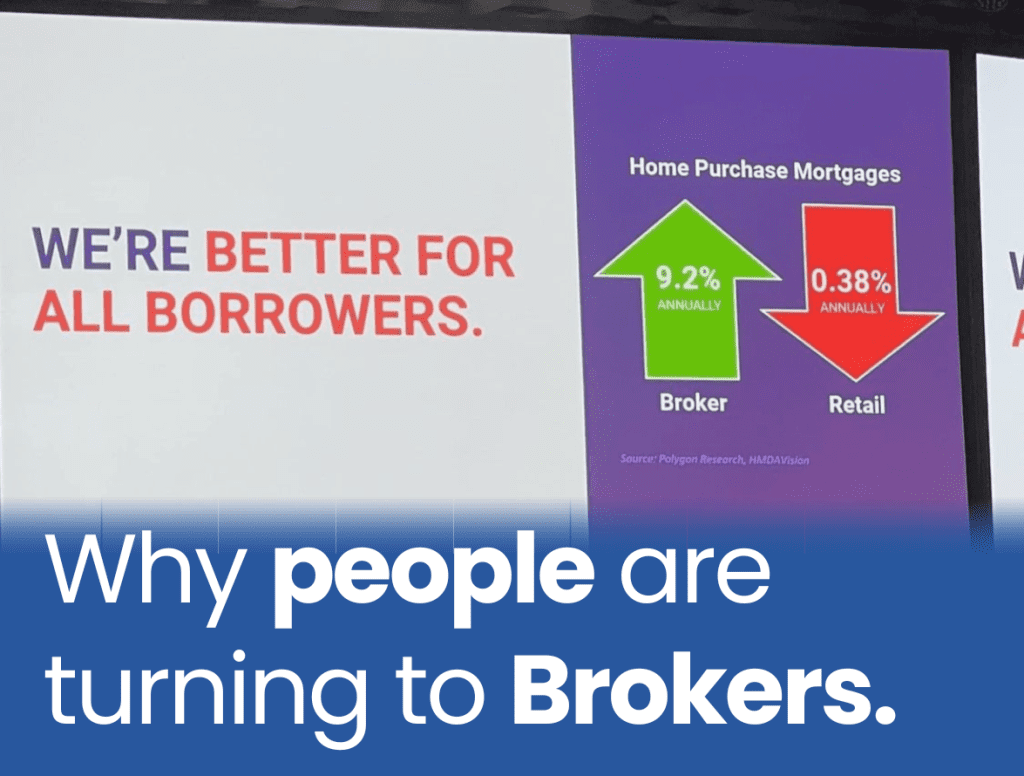

How Mortgage Brokers Help Provide an Unparalleled home buying experience.

Introduction In the labyrinth of mortgage financing, the distinction between mortgage brokers and mortgage bankers/retailers often remains veiled, leaving many homebuyers unaware of the significant benefits of choosing a mortgage broker over a mortgage banker/retailer. Understanding this contrast is pivotal for anyone navigating the path to homeownership. Explore the invaluable role of mortgage brokers in […]

How First-Time Homebuyers Dominate Mortgage Financing in Pennsylvania

Embarking on your journey of homeownership in Pennsylvania? This comprehensive guide is your key to understanding the advantages you have as a first-time homebuyer. From financial aid programs to city-specific grants, discover the opportunities that make Pennsylvania an ideal state for aspiring homeowners. Explore the diverse support offered by statewide and local organizations in Pennsylvania. […]

How First-Time Homebuyers Dominate Delaware: Quick Tips On Mortgage Options, Rates, Credit Score, And More!

Navigating the path to homeownership can be challenging for first-time buyers, but Delaware stands out as a state that actively supports and encourages this endeavor. With an array of programs designed to address financial constraints and provide educational resources, Delaware creates a conducive environment for individuals taking their initial steps into property ownership. Discover how […]

Optimistic 2024 Mortgage Rates and Housing Outlook From The Experts: Compared

Introduction As the real estate landscape navigates economic shifts and Federal Reserve policies, projections, and insights from various financial sources offer an intriguing and relatively optimistic outlook on the housing market and mortgage rate forecasts for 2024. Here’s what the big names in the industry are saying. Call us at 301-682-2113 for a local read […]

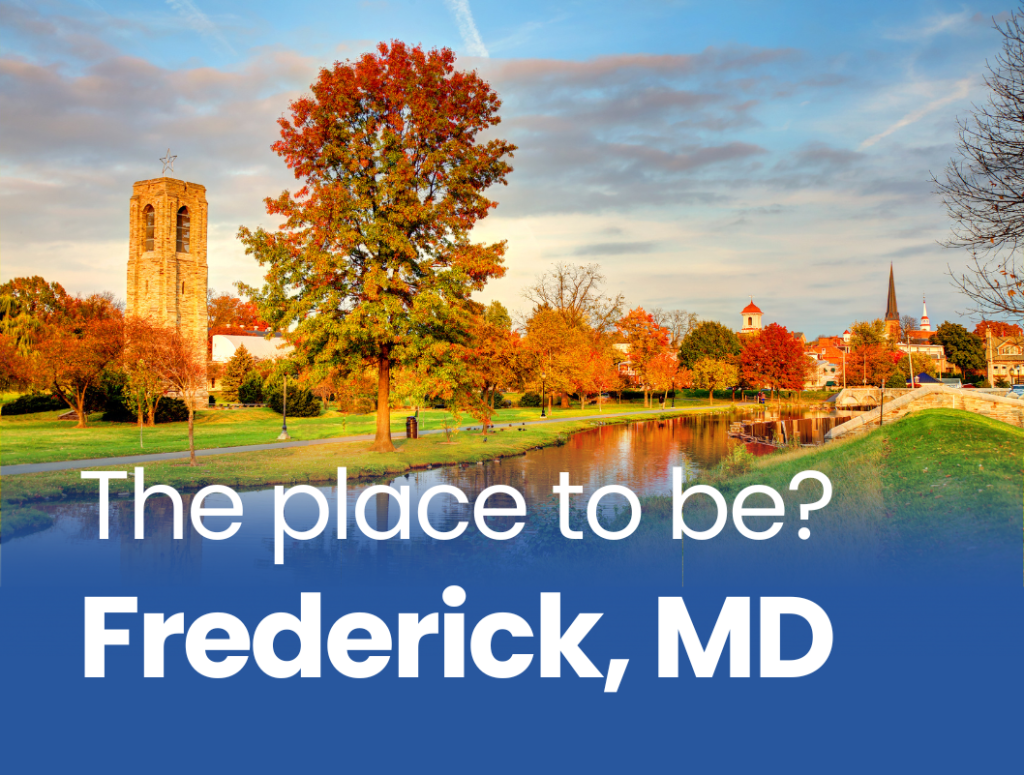

Frederick Maryland – The place to be according to everyone.

Introduction Our team has lived in Frederick for decades, and we just think the absolute world of it. But don’t take it from us. Here are just a few of the many times Frederick has been featured as one of the best places to visit or live in America. Discover why everyone says Frederick, Maryland […]

10 Tips for First-Time Maryland Home Buyers

10 Tips for First-Time Home Buyers The Exciting Journey of Becoming a Homeowner Are you ready to take the leap into homeownership? Congratulations! Buying your first home is an exciting milestone that comes with a sense of accomplishment and the opportunity to establish roots in a community. However, the process of buying a home can […]

Credit Scores and Preparing to Buy a Home

Introduction In today’s financial landscape, your credit score plays a crucial role in determining your eligibility for loans and credit. Whether you’re applying for a mortgage, car loan, or credit card, lenders rely heavily on your credit score to assess your creditworthiness. As a result, it’s essential to stay informed about your credit health and […]

The Key for First-time Home Buyers: lower down payments, grants, and more.

Navigating the housing market is especially daunting as a first-time homebuyer, but it can lend a key advantage over the homebuyers; that is access to State Mortgage Programs. These programs are designed to help make buying a house easier and more affordable for first time home buyers by providing low down payments, closing assistance, grants, […]

The Ultimate Guide to Understanding Mortgage Options: A Comprehensive Overview for Homebuyers

As a trusted mortgage broker, our goal is to empower homebuyers with the knowledge they need to make informed decisions about their mortgage options. In this comprehensive guide, we will delve into the various mortgage options available, providing insights and tips that will help you navigate the complex world of home financing. […]

Navigating the Mortgage Process with Ease: Tips and Insights for First-Time Homebuyers

Congratulations on embarking on the exciting journey of homeownership! As a trusted mortgage broker, we understand that the mortgage process can seem overwhelming, especially for first-time homebuyers. In this blog post, we will provide you with valuable tips and insights to help navigate the mortgage process with ease. From understanding your financial […]

Demystifying Mortgage Rates: What Factors Impact Interest Rates and How to Secure the Best Deal

When it comes to obtaining a mortgage, understanding mortgage rates is crucial for securing the best deal. As a trusted mortgage broker, we believe in empowering borrowers with the knowledge they need to navigate the complex world of interest rates. In this blog post, we will demystify mortgage rates, exploring the factors that […]